2024 Tax Accelerator Series Individual Returns Seminar

10 hours of CPD – delivered online in 4 x 2.5 hour modules

Are you ‘NTAA-ready’?

Are you a recent graduate or professional looking to master the challenges of preparing the ATO’s Individual income tax return (the ‘I’ Return)?

We have gone ‘back to basics’ and identified the practical knowledge and skills tax practitioners need to confidently complete the ‘I’ Return.

What is the ‘Tax Accelerator Series: Individual Returns’?

A dedicated seminar to enhance your confidence with employee, sole trader and investor clients. With guidance from our expert NTAA presenters you will receive 10 hours of CPD, including the questions and answers from our live streamed seminar.

How is the Tax Accelerator Series presented?

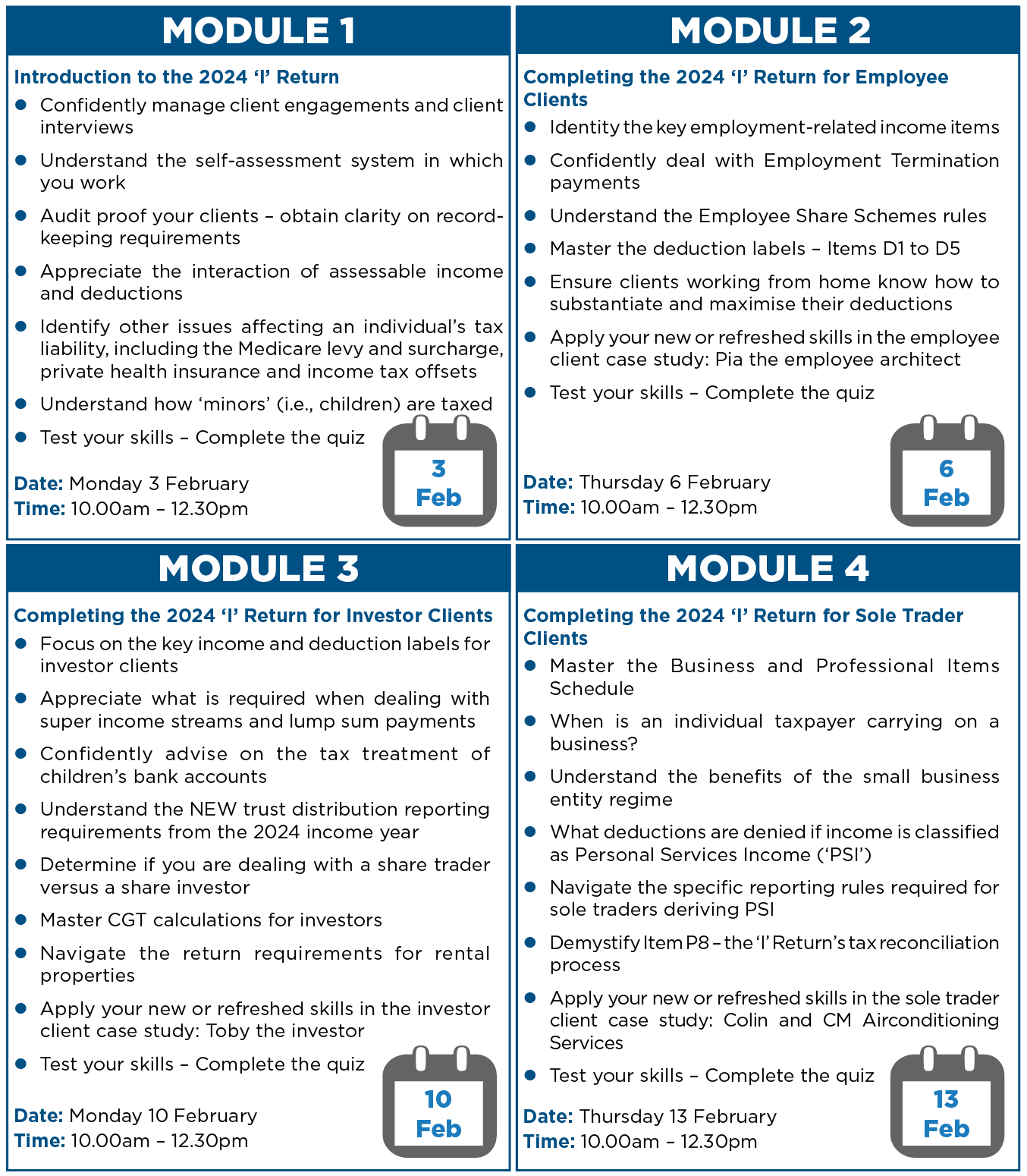

- Four x 2.5 hour Modules are available online now totalling 10 hours CPD

- Each module comes with comprehensive NTAA materials

- Each module includes the questions and answers from the live streamed seminar

- After each module, an optional quiz will reinforce your learning and understanding

Additional benefits for Attendees

- Free PDF of our Comprehensive Seminar Notes (Hard Copy $30 Extra)

- NTAA Tax Accelerator Series Toolkit

- NTAA Hotline Call

- NTAA's 2024 Deduction Finder

- 10 hours of CPD

All the recordings are available online NOW!

Presented by Rebecca Morgan and Fatma Hashim on behalf of the NTAA.

Click here for more information our Tax Accelerator Series: Business Returns Seminar