2024 Tax Accelerator Series Business Returns Seminar

10 hours of CPD – Four x 2.5 hour Online modules

Are you ‘NTAA-ready’?

Are you a recent graduate or professional looking to master the challenges of preparing the ATO’s business income tax returns?

We have gone ‘back to basics’ and identified the practical knowledge and skills tax practitioners need to confidently complete client business returns.

What is the ‘Tax Accelerator Series: Business Returns’?

This instalment of our Tax Accelerator Series focuses on preparing tax returns for business entities.

You will build ‘client focused’ skills to identify key technical issues and understand their practical application using specific examples and dedicated case studies.

With guidance from our expert NTAA presenters you will receive 10 hours of CPD over a four week period for manageable, in-depth learning.

Live streamed access to dedicated Q&A segments will allow for real-time answers.

How is the Tax Accelerator Series presented?

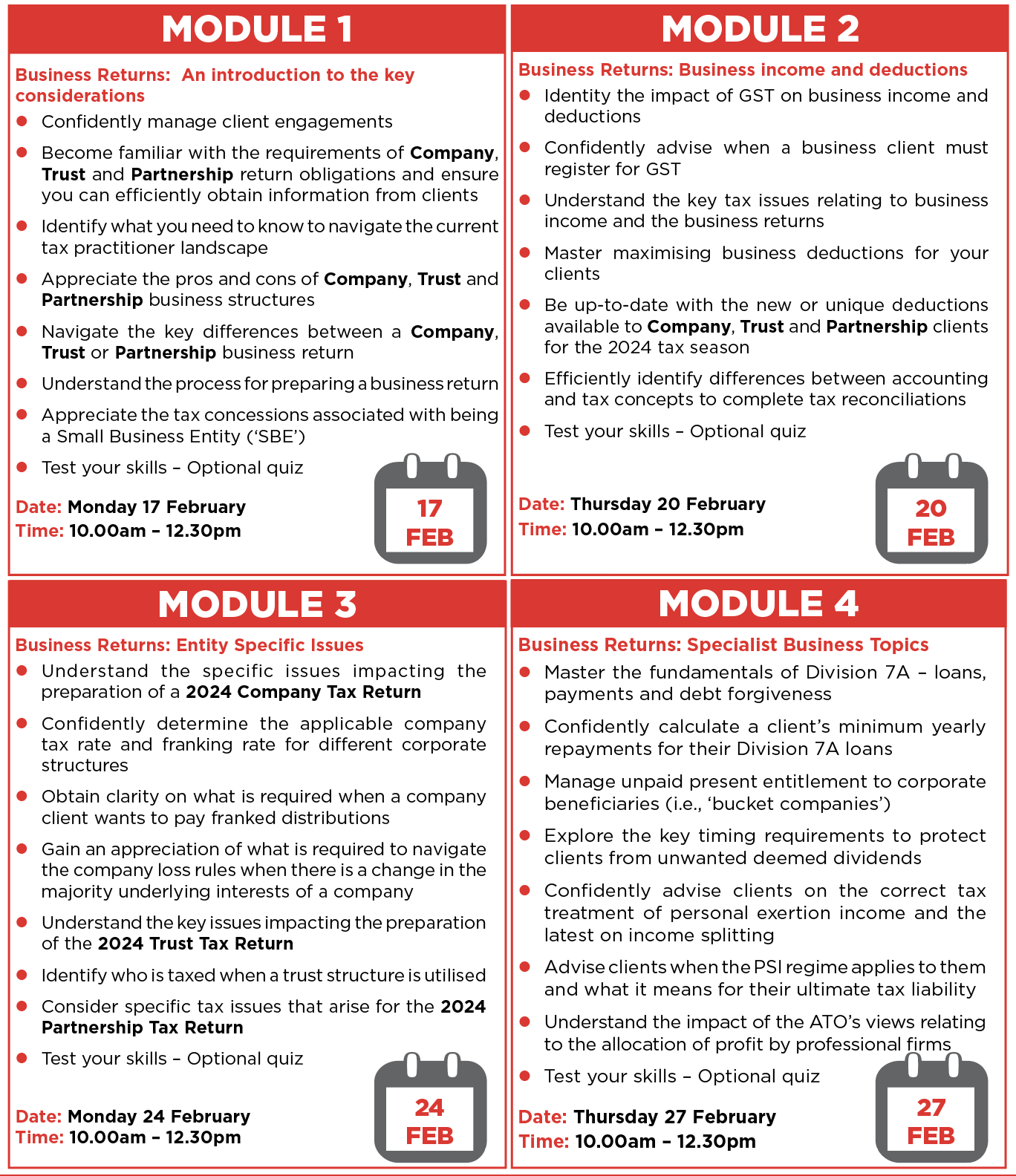

- Four x 2.5 hour Modules are available online now totalling 10 hours CPD

- Each module comes with comprehensive NTAA materials that attendees can rely upon in their daily practice and form the cornerstone of their tax technical library

- After each module, an optional quiz will reinforce your learning and understanding

Additional benefits for Attendees

- Free PDF of our Comprehensive Seminar Notes (Hard Copy $30 Extra)

- NTAA Tax Accelerator Series Toolkit

- Hotline Call

- 2024 Professional Risk Assessment Software ('PRAS')

- 10 hours of CPD

Presented by Rebecca Morgan and Fatma Hashim

Click here for more information our Tax Accelerator Series: Individual Returns Seminar